At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is a Beneficiary Deed?

A beneficiary deed is commonly associated with real estate and property because it is a document used to determine who will receive real estate property when the original owner dies. Those who receive the property as the result of the beneficiary deed are referred to as beneficiaries. This document is important because it allows for a smooth flow between past and present owners, without a long waiting period for probate.

A beneficiary deed is completed before the original owner passes away. Although it is re-titled in the beneficiary’s name at this time, the original owner still has rights to the property. He or she is still legally allowed to live on the property and can refinance it. The original owner can also rent out rooms for living space or office space. Essentially, the original owner can do whatever he or she pleases with the property until the time of his or her death, without the permission of the beneficiary.

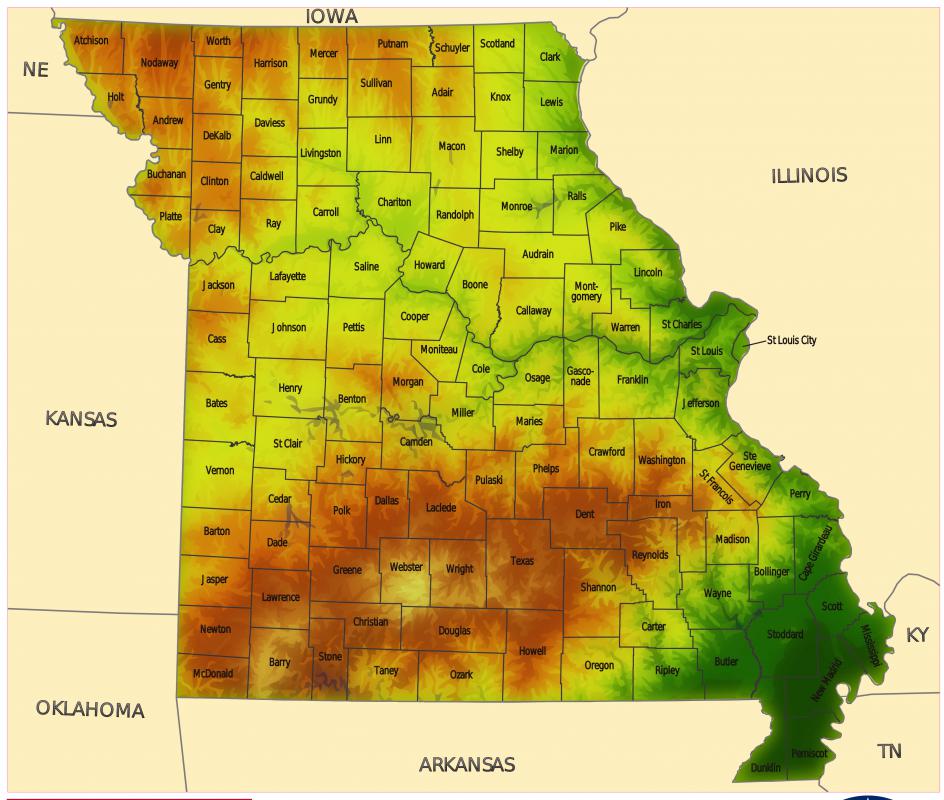

The legal aspects of beneficiary deeds vary from state to state. In Missouri, for example, the potential beneficiary is required to obtain spousal approval before he or she can be added to the deed. The spouse must present written consent to the transfer of property. In addition, the spouse is entitled to ask for half of the property as payment for signing the transfer allowing the deed to be completed.

In Colorado, the laws regarding beneficiary deeds are slightly different. First, an affidavit is required in order to avoid a full probate process with the beneficiary deed. In addition, the value of the personal property in question must not exceed 50,000 US dollars (USD). Colorado law also states that beneficiary deeds must be recorded before the death of the owner. The penalty for not recording the deed results in the beneficiary losing rights to the property, as it reverts back to the owner’s probate estate.

While the original owner is still alive, he or she can re-direct the beneficiary deed to someone other than the original beneficiary. In order for the new beneficiary to be recognized, however, the original owner needs to obtain a recorded revocation before creating a new deed.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Can a beneficiary deed be done on a property with a lien on it?

Can the state of Missouri bypass a beneficiary deed to claim property for a medicaid claim?

If I understand this article, it's not possible for me to complete a beneficiary deed on my house because it is worth approximately $160,000. Is this correct? If so, $50,000 seems a very low limit these days. What other options to I have if I want to spare my next of kin all the probate hassle?

My husband and I both reside in Missouri. We have completed a beneficiary deed to our children. After reading some others comments, do the kids have to pay taxes on 1099 forms others say they received, or what about Medicare, if they later claim they needs monies from the home due to services received?

Again, I am only looking down the line, into probable issues the kids might have down the road. Hopefully way down the road!

I have made out a beneficiary deed to my 24 year old son who is now graduating from college. My home if free of debt and I am in good health. He recently found out his college loan has been sold to another company and they have not credited his account from monies of various sources for the last four years. If he does not get this worked out, can they come after my house to collect what they think is due them?

We are in a similar sitution as post #6 - I would interested to know the answer to the question. Parents passed, had beneficiary deed, state considering claim for medicaid.

I live in Arkansas and am widowed. If I do a beneficiary deed to both of my sons, will this bypass probate? Will there be any tax consequence to either myself or them. My home (mortgage free) and one piece of rental property (mortgage free). Thank you

Does a beneficiary deed in Arkansas transfer ownership to beneficiaries without any taxes to benefieiaries? Am I right about it not passing through probate?

A Trust was created to leave a home to father and mother's children. Mother passed and father deeded home to new wife. The change of deed states, with consent of the the children, but they did not consent.

Father has been married to new wife for 11 years and did the change without permission. The new Trust is a living Trust. Do the children have any claim upon his death? Melia

I co-own property with my brother through a beneficiary deed. I live on the land, pay *all* taxes, and insurance. My brother does not live on the land and he is renting to a very nasty family that aggravates us and alters property. Can I charge them rent for being on 50 percent of my land? Or evict them? I do not get any money from these people living on this land, which is 50 percent mine.

Help! My mother died in 2007. Father died in June 2008. Father had a will leaving Missouri farm to his children. Lawyer filed a Beneficiary Deed. We sold farm in Oct. 2008. Money put into Father's account to pay medical bills, etc. Whatever remains after the year date of his death or after all the medical bills have been received will be divided between the three of us.

I received a 1099 for 1/3 of the price of the farm. Am I going to have to pay 2008 taxes (federal and NJ) on money that I may never received?

My mother passed away over a year ago and I was the recipient of her home in a beneficiary deed. The state now has a claim against the estate for money they paid to a nursing home (Medicaid) for the 4 years she was there. The only asset left was the home and it transferred on death. Is it likely they will set aside the deed to collect what is due?

My grandmother owned a home and listed my mother and my aunt (her two daughters) as the beneficiaries. My aunt passed away 3 years ago and my grandmother never thought to change the beneficiary deed. Does the house go straight to my mother? She is needing to sell it because she cannot afford to live there on her own. My aunt had two kids, do they have to sign quit claim deeds in order for my mom to be able to sell the house?

Please advise soon.

Thanks

My mother died several years ago and left me a parcel of land in Texas in her last will and testament. The warranty deed was lost before her death. I currently pay taxes on the property and the assessor has transferred the taxes into my name. How do I get a deed in my name?

My brother recently passed away. Prior to his death we executed a beneficiary deed and filed it with the county recorder as required (Colorado). What process is required in order to properly transfer the title to my name?

My mom recently passed away. Before she passed she completed a Beneficiary Warranty Deed leaving the house to my brother and myself. My question is can the credit card companies force us to sell the house to collect the debt? My brother remains in the home. Thank you.

I am married & live in state of Missouri & am separated from husband with no intentions of returning to marriage. My father owns a home & is considering filling out a beneficiary deed with me as beneficiary so that I can get the house in the event of his death. Can he legally do this while I am married without my husband getting involved & having any rights to property along with me?

Post your comments